TNS Experts

This post was submitted by a TNS experts. Check out our Contributor page for details about how you can share your ideas on digital marketing, SEO, social media, growth hacking and content marketing with our audience.

Explore how advanced paystub tools forge stronger client bonds and foster financial literacy.

Imagine a world where every financial transaction is not just an exchange of currency but a building block for a lasting relationship. In the realm of business, the art of cultivating connections hinges on trust and empowerment.

With over a decade of weaving words for esteemed platforms like Entrepreneur Magazine and Inc.com, I've seen the transformative power of financial tools in sculpting this narrative. Paystubs, often overlooked, are not mere slips of paper; they are a testament to transparency and an open door to savvy financial dialogue.

This discourse ventures into the realm where advanced paystub tools do more than report earnings—they educate, empower, and engender loyalty.

In a digital age where financial interactions often lack a personal touch, a rising currency in the marketplace is reshaping the business landscape: the currency of relationships. As a seasoned wordsmith with ten years of crafting compelling narratives, I've witnessed firsthand the metamorphosis of financial transactions into relational milestones.

In this evolution, paystubs have emerged as an unexpected hero. Once a mere afterthought in the payroll process, they now serve as a beacon of trust and financial empowerment. They are not just a record of payment but a testament to a company's integrity and commitment to its clients' financial well-being.

This article will unravel the untold power of paystubs in building lasting relationships, going beyond the numbers to foster a culture of financial enlightenment and mutual growth.

Financial interactions are the heartbeat of any business-client relationship. However, the true potential of these interactions often remains untapped, lurking beneath the surface of every transaction, invoice, and, most notably, paystub.

The role of financial tools in relationship building is pivotal, as they carry the potential to transform a simple monetary exchange into a cornerstone of trust and loyalty. Financial interactions are the heartbeat of any business-client relationship.

However, the true potential of these interactions often remains untapped, lurking beneath the surface of every transaction, invoice, and, most notably, paystub. The role of financial tools in relationship building is pivotal, as they carry the potential to transform a simple monetary exchange into a cornerstone of trust and loyalty.

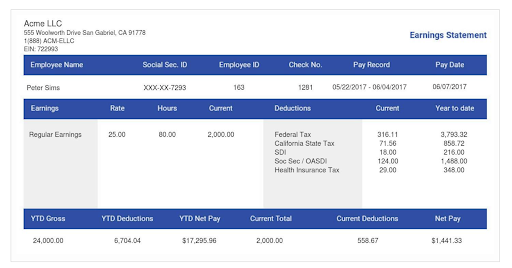

Straight paystubs cut through the noise in a marketplace cluttered with fine print and hidden fees. Consider the case of a local craftsman whose business soared when he started providing itemized paystubs to his employees and contract clients.

The detailed breakdown fostered an environment where trust was the default, resulting in heightened morale and client retention.

One cannot overstate the psychological impact of financial empowerment. When clients understand the 'how' and 'why' of their earnings, taxes, and deductions, they feel more in control of their financial destiny.

This sense of control empowers, fosters a deeper connection with the business, and elevates the financial conversation beyond the paycheck.

Empowerment is the buzzword in the modern business lexicon, but its essence is deeply rooted in education. Financial literacy is not just a value-added service; it's a cornerstone of empowerment that businesses can provide, using tools as seemingly mundane yet crucial as paystubs.

Imagine a world where every business conducts quarterly financial literacy workshops using paystubs as the curriculum. This proactive approach doesn't just build financial acumen—it builds relationships. Clients start to see these businesses not just as service providers but as partners in their financial journey.

Educated clients are engaged clients. When they understand their finances, they are more likely to appreciate the services that contribute to their financial stability. This understanding deepens their engagement with the business, leading to increased loyalty and retention.

Nothing underscores the value of financial empowerment tools more than real-world examples. These narratives bring to life the concepts of trust and education, illustrating paystubs' profound impact on businesses and individuals.

Employees felt valued and became ambassadors of the brand, while customers, seeing the bakery's commitment to fair trade and transparency, became repeat patrons.

This small addition transformed their paystubs into newsletters, creating a personal touch that resonated with clients and differentiated the business in a crowded market.

These stories illustrate a ripple effect, where the simple act of providing clarity through paystubs can lead to profound changes in people's lives. By fostering an environment of transparency and empowerment, businesses not only contribute to their client's financial literacy but also to a more financially aware society.

The benefits of financial empowerment tools extend far beyond the immediate transaction. They facilitate a deeper understanding and appreciation of the value provided by the business, leading to a long-term relationship built on a solid foundation of trust and shared knowledge.

As we march forward in the 21st century, technology continues to revolutionize how businesses operate and interact with their clients. Paystub generation, a process that was once manual and prone to errors, has seen significant advancements, each iteration bringing us closer to a seamless financial experience.

The integration of paystub generators with personal finance management tools is a game-changer. Clients can automatically import their paystub data into budgeting and investment apps, streamlining their financial management and decision-making processes.

Some paystub generators have incorporated interactive features, such as hover-over explanations for each line item and links to resources for financial education. These features make paystubs more user-friendly and turn them into an interactive financial learning tool.

Paystubs can play a pivotal role in the intricate dance of client relations. They are not just a legal requirement or administrative formality; they can become a powerful touchpoint for engagement and education when used strategically. Here are some tips to maximize the relational value of paystubs.

Consider incorporating paystubs into a broader financial wellness program. This can include regular financial health check-ins, access to financial planning services, or even partnerships with financial advisors. Such initiatives show clients that you care about their overall financial well-being, not just the transactions.

Embrace technology to provide proactive information through pay stubs. Send out alerts or notifications when new paystubs are available and include updates on any financial news that could affect their understanding or use of the paystub, like tax changes or new benefits.

As we look ahead, it's evident that financial tools will play an increasingly deeper role in client relationships. The symbiosis of technology and finance is paving the way for an era where paystubs are not just records but instruments of empowerment and engagement.

We expect Artificial Intelligence (AI) to significantly influence the evolution of paystub management, offering personalized insights and recommendations based on individual financial patterns and goals.

As financial tools evolve, the emphasis on user-centric design will grow. Paystubs and other financial documents will become more personalized, reflecting each client's unique needs and preferences, making financial management an intuitive part of daily life.

The financial landscape is undergoing a transformation, with paystubs at the forefront of this change. As businesses continue to leverage these tools for more than just transactions, they nurture relationships that are rooted in trust, education, and mutual financial success.

The future beckons with the promise of even more integrated, interactive, and empowering financial tools, promising a new era of client engagement and financial literacy. In this dynamic future, paystubs will reflect where we've been and a roadmap to where we're going with our clients.

You’ll also receive some of our best posts today

This post was submitted by a TNS experts. Check out our Contributor page for details about how you can share your ideas on digital marketing, SEO, social media, growth hacking and content marketing with our audience.

Mobile devices have become an integral part of our lives in this digital...

Don’t miss the new articles!